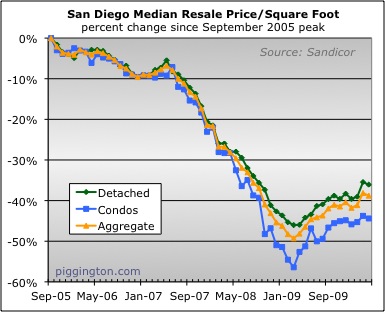

After March’s surge to the upside, the median price per square foot

pulled back in April:

Single family homes, condos, and the aggregate were all down around

1%. But this is after a rise of about 5% in March, so prices by

this measure are still the highest they’ve been since September 2008

(exclusive of the prior month, of course).

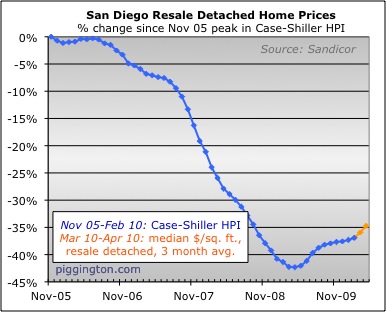

The Case-Shiller proxy, which uses a 3-month average, was up robustly

once again:

As I said last month, I suspect that some of the recent price rise is

due to compositional shift and thus not “real.” So while I do

believe

that prices are rising, I suspect that the real Case-Shiller index will

show an increase that is more muted.

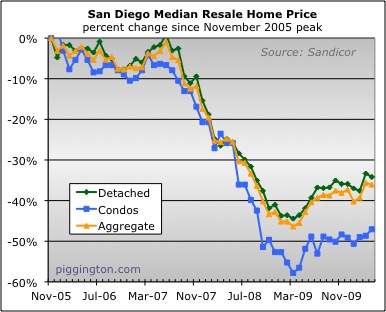

The vanilla median was more mixed than the median price per square

foot, with condos pulling off an increase:

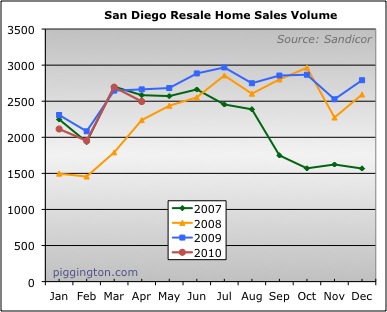

Sales were actually weak, falling over 7% in a month when they rose

last year:

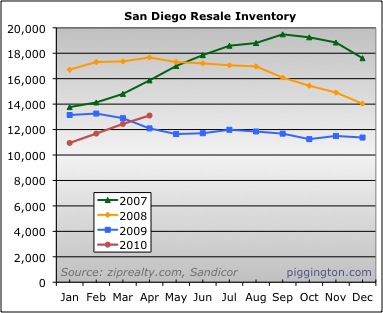

And inventory finally appears to be on the upswing:

Lower sales and higher inventory made for a jump in the

months-of-inventory figure to over 5:

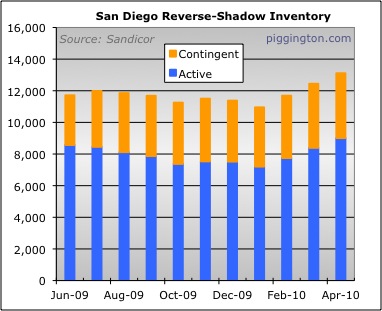

The increase has incidentally taken place in the active inventory

category, so these are more actual homes for sale, as opposed to homes

caught up in contingent status:

Here’s what I wrote at voiceofsandiego.org about the decline in sales

and (assuming the median price per square foot is providing a good

read) pricing:

Why the dip? It could be noise, but there’s another

potential

explanation as well. As many readers have doubtless read

elsewhere, we are in a brief period in which Californians can get two

home buyer tax credits: the Federal credit, and the new California

credit. (Why a state with serial budget crises is spending $100

million to render its housing supply less affordable is a topic for

another time). The Federal credit is good through June, but the

California credit didn’t start up until May. So in order to

double-dip, buyers need to close in May or June.The idea I’m working toward is that some buyers might have wished to

wait until May to close their sales, rendering April a weak month for

closings… This lack of demand to

buy in the month of April might have exerted some downward pressure on

prices.

As I also wrote, if this is what’s going on, we can expect this process

to go into reverse next month. So demand and potentially pricing

could pick up further in the months ahead, at very least until the

California tax credit runs out.

Meanwhile, we are finally seeing inventory start to grow in a sustained

manner. If that keeps up it could lead to increased activity as

more frustrated buyers’ demands are able to be met. At the same time,

it could take some wind out of the market’s sales price-wise.