By 2001, San Diego had enjoyed a nice housing boom. Since bottoming out in 1996 after a nasty housing downturn, the price of the typical single family home had risen by 74 percent. As of 2001, adjusted for inflation, San Diego homes were more expensive than they’d ever been (at least since the 1970s, which is as far back as the available data goes).

At this point, one might have expected home price growth to slow down or even flatten out. But the show was only getting started. The typical home, already somewhat richly valued, would go on to nearly double in price in just a few years.

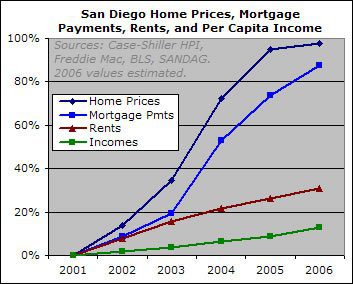

Interestingly, this price explosion occurred at a time when rents were growing fairly modestly. This is somewhat strange because the factors that typically drive home prices, such as incomes, employment, and population growth, also affect rents. Yet after 2001, while prices of already richly-valued homes increased 98 percent and the monthly payments on those homes rose 88 percent, rents only increased 31 percent.

The San Diego Housing Bubble

By 2001, San Diego had enjoyed a nice housing boom. Since bottoming out in 1996 after a nasty housing downturn, the price of the typical single family home had risen by 74 percent. As of 2001, adjusted for inflation, San Diego homes were more expensive than they’d ever been (at least since the 1970s, which is as far back as the available data goes).

At this point, one might have expected home price growth to slow down or even flatten out. But the show was only getting started. The typical home, already somewhat richly valued, would go on to nearly double in price in just a few years.

Interestingly, this price explosion occurred at a time when rents were growing fairly modestly. This is somewhat strange because the factors that typically drive home prices, such as incomes, employment, and population growth, also affect rents. Yet after 2001, while prices of already richly-valued homes increased 98 percent and the monthly payments on those homes rose 88 percent, rents only increased 31 percent.